|

| Sunset Dance - Pismo |

In order to make it easier to see what questions have been answered all the Q&A responses from Susy Forbath have simply been cut apart and organized, nothing has been changed. Each question has been referenced back to the document date and page in case you want to go back to the original document. I am keeping a complete set of documents in case one of yours "goes missing."

Categories are:

Purchase

Financing

Rent/Lease

HOA

GeneralThere is also a category of "Unanswered Questions" ... if you have a question, please feel free to add it in the comment section below and I will make sure that they are all submitted to Susy.

NOTE: Please help make sure this information is timely and correct by adding your comments, questions and suggestions. Feel free to email me ... jwycoff@me.com.

Purchase information.

Update: 10/31/2013 Opening Escrow

The owner has offered some purchase incentives for residents who OPEN escrow within the first 90 or 60 days. In a conversation with Mary Jane Ponder of Fidelity National Title Insurance Company in Arroyo Grande, there is no specific limits to how long escrow can be held open. There's probably a reasonableness factor here ... however, residents who are at all interested in purchasing their lots should probably open escrow soon after the date of conversion in order to lock in the incentives.

Q: If I don't buy my lot immediately, will someone else be able to?

A: Yes. While it would be unusual, the Park Owner could sell the lots to another buyer or investor. You would then pay your space rent to that new owner. (Author Note: This question was answered verbally by Richard Close and Susy Forbath after a small meeting on July 30, 2013 - JW)

Q: If I choose to buy my lot, what will I be buying?

A: Through the process of conversion to resident ownership every resident will have the option to acquire an ownership interest in the Park. Each ownership interest would include a lot, which is comprised of your current space (including the land under your home approximately 18 inches deep), and 1/304th interest in the Park's common area. (Document: 2, page 2)

Q: Will I get a grant deed to the land?

A: Yes, the property will be transferred to you by a grant deed and insured by a policy of title insurance. (Document: 2, page 2)

Q: Why will my property description only include 18 inches in depth?

A: Because most mobile home parks were built with utility lines running under the lots (2-3 feet deep), conversions of parks are done much the same as condominiums, so that the utility lines would remain as part of the "common area" to be owned jointly by all lot owners and controlled by a homeowners association (HOA). This eliminates any easement issues or personal responsibility for utility repairs by the individual lot owners. As a lot owner you would own the land beneath your home, but would not directly own or be responsible for the utility lines. (Document: 2, page 2)

Q: Who will own the common area?

A: Purchasers will each own a percentage interest in the common area. All of the Park will be controlled by the lot owners through an HOA. The current Park owner will also share ownership in the common areas in the same percentage of the lots that have not yet been purchased. (Document: 2, page 3)

Q: Can the Park Owner sell lots for whatever he wants?

A: No. The park owner has agreed that an appraisal will be made prior to application to the DRE (Department of Real Estate) for permission to sell lots. A licensed MAI appraiser will be hired by the park owner based upon the appraiser's knowledge of the area, of mobile home parks, and by reputation. His appraisal must be realistic and his reputation will be on the line, as with any appraiser on any real estate appraisal. Based upon the appraisal, the park owner will decide the cost, which must also satisfy loan approval qualifications. (Document: 2, page 4)

Q: When will I know the price of my lot?

A: Residents will be provided lot prices at least six months before the option to purchase will be available. The Tentative Map Approval by the County is only the first step in the long process of conversion. After the Tentative Map approval the park owner must still hire a surveyor to prepare the Condominium Map and Plan, obtain Final Map Approval, and complete all compliance requirements for application to the Department of Real Estate (DRE).

The appraisal will not be conducted until after the Tentative Map Approval by the County. However, tentative prices must be publicized at the time of application to the DRE. Obtaining a DRE Public Report typically takes approximately six to nine months after submittal of the application (which includes current lot values). State law provides that once the Public Report is delivered to each resident, the established lot values may not change for 90 days. (Document: 2, page 4)

HOWEVER, The owner of Mesa Dunes has agreed to extend the statutory "fixed" purchase price period from 90 days to six months. This means that you will know the value of the land for at least six months, and then you will have another six months in which to decide to purchase at that locked-in price.

ADDITIONALLY - The owner of Mesa Dunes has several purchase incentives (including price discounts) that he is offering ... see Basics of the Offer.

Q: Will I get a grant deed to the land?

A: Yes, the property will be transferred to you by a grant deed and insured by a policy of title insurance. (Document: 2, page 2)

Q: Why will my property description only include 18 inches in depth?

A: Because most mobile home parks were built with utility lines running under the lots (2-3 feet deep), conversions of parks are done much the same as condominiums, so that the utility lines would remain as part of the "common area" to be owned jointly by all lot owners and controlled by a homeowners association (HOA). This eliminates any easement issues or personal responsibility for utility repairs by the individual lot owners. As a lot owner you would own the land beneath your home, but would not directly own or be responsible for the utility lines. (Document: 2, page 2)

Q: Who will own the common area?

A: Purchasers will each own a percentage interest in the common area. All of the Park will be controlled by the lot owners through an HOA. The current Park owner will also share ownership in the common areas in the same percentage of the lots that have not yet been purchased. (Document: 2, page 3)

Q: Can the Park Owner sell lots for whatever he wants?

A: No. The park owner has agreed that an appraisal will be made prior to application to the DRE (Department of Real Estate) for permission to sell lots. A licensed MAI appraiser will be hired by the park owner based upon the appraiser's knowledge of the area, of mobile home parks, and by reputation. His appraisal must be realistic and his reputation will be on the line, as with any appraiser on any real estate appraisal. Based upon the appraisal, the park owner will decide the cost, which must also satisfy loan approval qualifications. (Document: 2, page 4)

Q: When will I know the price of my lot?

A: Residents will be provided lot prices at least six months before the option to purchase will be available. The Tentative Map Approval by the County is only the first step in the long process of conversion. After the Tentative Map approval the park owner must still hire a surveyor to prepare the Condominium Map and Plan, obtain Final Map Approval, and complete all compliance requirements for application to the Department of Real Estate (DRE).

The appraisal will not be conducted until after the Tentative Map Approval by the County. However, tentative prices must be publicized at the time of application to the DRE. Obtaining a DRE Public Report typically takes approximately six to nine months after submittal of the application (which includes current lot values). State law provides that once the Public Report is delivered to each resident, the established lot values may not change for 90 days. (Document: 2, page 4)

HOWEVER, The owner of Mesa Dunes has agreed to extend the statutory "fixed" purchase price period from 90 days to six months. This means that you will know the value of the land for at least six months, and then you will have another six months in which to decide to purchase at that locked-in price.

ADDITIONALLY - The owner of Mesa Dunes has several purchase incentives (including price discounts) that he is offering ... see Basics of the Offer.

(Author: The following is Document #20 Susy Forbath's response to

William Constantine's "7 Questions" ... Document #19)

Q #1 (and 2) - Is the price of my lot going to be fair and affordable to me? Won’t the

park owner’s promise to have lot prices determined by a licensed appraiser assure they

will be fair and reasonable?

A – The lot prices will be determined by a licensed appraiser who is experienced in mobilehome park valuations. Contrary to statements made by Mr. Constantine, the appraiser is expected to primarily rely on comparable sales prices of lots in other resident-owned parks in the area ("comps," as typical with other home or land sales), as is standard in the appraisal industry. Moreover, the park owner will discount the appraised values when offering the lots for sale to residents.

Mr. Constantine’s mis-information purports to rely on a single instance, from over ten years ago, in the Coachella Valley. At that time there were very few “comps” that could be used. Today, however, there are many more resident-owned parks and lot sales available, including in SLO County. Mr. Constantine’s convoluted scenario also relies on numbers he has apparently invented to arrive at a conclusion he predetermined, apparently intended to confuse and scare residents.

As with any subdivider, the park owner’s goal is to sell as many lots as soon as possible. Valuation of the lots will need to be competitive with values in the local area in order to sell the lots. Pricing the lots above fair market value or at unaffordable levels is simply not in its interest, because people would not buy them. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

A – The lot prices will be determined by a licensed appraiser who is experienced in mobilehome park valuations. Contrary to statements made by Mr. Constantine, the appraiser is expected to primarily rely on comparable sales prices of lots in other resident-owned parks in the area ("comps," as typical with other home or land sales), as is standard in the appraisal industry. Moreover, the park owner will discount the appraised values when offering the lots for sale to residents.

Mr. Constantine’s mis-information purports to rely on a single instance, from over ten years ago, in the Coachella Valley. At that time there were very few “comps” that could be used. Today, however, there are many more resident-owned parks and lot sales available, including in SLO County. Mr. Constantine’s convoluted scenario also relies on numbers he has apparently invented to arrive at a conclusion he predetermined, apparently intended to confuse and scare residents.

As with any subdivider, the park owner’s goal is to sell as many lots as soon as possible. Valuation of the lots will need to be competitive with values in the local area in order to sell the lots. Pricing the lots above fair market value or at unaffordable levels is simply not in its interest, because people would not buy them. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

Financing information.

Q: What financing options are available for lower-income residents who want to purchase?

A: A State funded program currently exists through the California Dept. of Housing and Community Development (HCD) called the Mobilehome Park Resident Ownership Program ("MPROP"). MPROP was established to finance affordable home ownership through conversion to resident ownership. This program is available to residents who wish to purchase their land and qualify as a lower-income household.

MPROP offers long-term (30-year) loans at 3% simple annual interest, to lower-income residents of a mobile home park that has been converted, to ensure housing affordability when the resident purchases their unit in the park. The loan does not cover the entire purchase price, but is often paired with a conventional loan and provides, on a sliding scale, an amount sufficient to secure a monthly payment that is affordable for the individual resident. MPROP exists solely to provide lower-income residents with the opportunity to own an interest in the park in which they live. (Document: 2, page 3)

Q: What other financing options are available?

A: After subdividing the land, homeowners and residents will have more options to finance both their land and home. For a rental mobile home, lenders will typically offer only short-term personal property loans with high interest rates, similar to car loans. However, where the home and the land will both be owned by the homeowner, some lenders will provide conventional home loan financing, with a typically longer term (e.g., 30 years) and much lower interest rates.

Funding is also available through the Cal Vets program regardless of income level. (Document: 2, page 3)

Q: If the State is "broke" -- how can it make loans to low income residents who wish to purchase?

A: A State funded program operated by the Department of Housing and Community Development, called MPROP, exists to make home ownership practical and affordable to low-income residents who wish to purchase their lot by providing low-interest (3% simple annual interest) loans. (please see HCD website - http://housing.hcd.ca.gov/fa/mprop/

MPROP is available to residents who choose to purchase their lot and who qualify as a lower-income household as defined by the lower income limits provided by the HCD each year. The MPROP program is funded through the annual fees/taxes paid to the State by mobile home owners.

If there is sufficient interest by lower income residents to purchase in Mesa Dunes, we will assist with obtaining MPROP loans on your behalf, and will also encourage the County to support the application process which increases the likelihood of obtaining financing.

Q #4 - I am low-income and would like to consider purchasing my lot, but I’ve heard

some people say the State low-income loan program doesn’t have enough money to go

around.

A – A State-funded program exists through the Department of Housing and Community Development Division of Financial Assistance, called the Mobilehome Park Resident Ownership Program ("MPROP"). Because of the limited number of applications the state receives each year, there have been sufficient MPROP funds to fund every park that has qualified for funding in recent memory.

MPROP provides up to two million dollars per park, or possibly more depending on availability, per year. A park may reapply for additional funding each year until all lower-income residents who wish to purchase have received funding.

The MPROP program exists to provide low-income residents the opportunity to own their land in the park in which they live and to secure and maintain affordable monthly housing payments. It provides long-term (30-year) loans at 3% simple annual interest.

In order to ensure affordability, the monthly MPROP loan payments are based upon income, rather than purchase price. The loan is not intended to cover the entire purchase price, but is often paired with a conventional loan and provides, on a sliding scale, an amount sufficient to secure total monthly housing costs (including utilities, insurance and taxes) that are affordable for low-income households.

A – A State-funded program exists through the Department of Housing and Community Development Division of Financial Assistance, called the Mobilehome Park Resident Ownership Program ("MPROP"). Because of the limited number of applications the state receives each year, there have been sufficient MPROP funds to fund every park that has qualified for funding in recent memory.

MPROP provides up to two million dollars per park, or possibly more depending on availability, per year. A park may reapply for additional funding each year until all lower-income residents who wish to purchase have received funding.

The MPROP program exists to provide low-income residents the opportunity to own their land in the park in which they live and to secure and maintain affordable monthly housing payments. It provides long-term (30-year) loans at 3% simple annual interest.

In order to ensure affordability, the monthly MPROP loan payments are based upon income, rather than purchase price. The loan is not intended to cover the entire purchase price, but is often paired with a conventional loan and provides, on a sliding scale, an amount sufficient to secure total monthly housing costs (including utilities, insurance and taxes) that are affordable for low-income households.

Loans are also available through the Cal-Vet program. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

Q #5 – I already have a loan on my home. Attorney Constantine says I can’t get a loan if I currently have a loan on my home.

Update: Michael Fitzgibbons from Murphy Bank stated specifically in a living room meeting on October 31, 2013, that current mortgages could be wrapped into the financing for lots as long as requirements are met ... 20% down payment, mortgage plus impounds (HOA fees, taxes and insurance) are 28% or less of income, god credit.

A – Untrue! Upon conversion, residents will have more attractive financing options. Your current loan on your home is likely a personal property loan (similar to a car loan) with higher interest rates and spread over a shorter term than a conventional home loan. Upon conversion, your home and the subdivided property can be re-financed as real estate with a conventional home loan. Home loan rates are typically much lower than personal property loans, and usually are spread over a much longer period because of the value and security of the land.

For those residents who choose to purchase their lot, and who currently own their homes debt-free or have significant equity, the value of the home will be considered in the loan-to-value ratio (LTV), potentially providing the equity to serve as the down payment for the loan.

In fact, after conversion, there is often greater interest by people wishing to purchase in the park because prospective owners will have better loan options as well as a more secure and financially sound investment with the ownership of the home and land versus only a leasehold interest. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

Q #5 – I already have a loan on my home. Attorney Constantine says I can’t get a loan if I currently have a loan on my home.

Update: Michael Fitzgibbons from Murphy Bank stated specifically in a living room meeting on October 31, 2013, that current mortgages could be wrapped into the financing for lots as long as requirements are met ... 20% down payment, mortgage plus impounds (HOA fees, taxes and insurance) are 28% or less of income, god credit.

A – Untrue! Upon conversion, residents will have more attractive financing options. Your current loan on your home is likely a personal property loan (similar to a car loan) with higher interest rates and spread over a shorter term than a conventional home loan. Upon conversion, your home and the subdivided property can be re-financed as real estate with a conventional home loan. Home loan rates are typically much lower than personal property loans, and usually are spread over a much longer period because of the value and security of the land.

For those residents who choose to purchase their lot, and who currently own their homes debt-free or have significant equity, the value of the home will be considered in the loan-to-value ratio (LTV), potentially providing the equity to serve as the down payment for the loan.

In fact, after conversion, there is often greater interest by people wishing to purchase in the park because prospective owners will have better loan options as well as a more secure and financially sound investment with the ownership of the home and land versus only a leasehold interest. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

Rent/Lease information.

Q: After the conversion, if I do not choose to purchase my lot, what will happen to my current lease?

A: If you are currently residing on a long-term lease, you will have the option to continue your lease to its termination, or to terminate your lease at the time of conversion and rent under the provisions of State law as described below. (Document # 2, page 1)

Q: After the conversion, if I do not choose to purchase my lot, what will happen to my rent?

A: If you are a lower income household: Conversions are only permitted under State law with strict rent control protection for lower-income residents who choose to continue residence as a tenant. Your rent increases will be limited for as long as you live in the Park.

Rent for lower-income residents will not go up any faster than allowed under local rent control (if applicable), and may increase less. After conversion, rents may only increase by the amount of the average increase in the prior four years (e.g. if rent has increased an average of $5 a year over the past four years, future annual rent increases can only be $5) or by the recent inflation rate (CPI), whichever is less. This provides certainty and security by using a formula for calculating rents for as long as you choose to reside in the park.

To qualify as a lower-income household for calendar year 2013:

(Document # 2, page 1)

A: If your household is above lower income: The monthly rent may gradually increase to market levels in equal annual increases over a four-year period. The "market" rent must be determined through an appraisal conducted by nationally recognized professional appraisal standards.

HOWEVER - In an effort to lessen any possible impact to renters, the owner of Mesa Dunes has opted to extend the gradual increase to a five-year period.

State rent control further protects all non-purchasing residents because it does not allow additional rent increases for capital improvements, a fair return on investment, or government mandated expenses, or similar additional rent increases, and provides certainty by using a formula for calculating rents.

(Document # 2, page 2)

Q: After the conversion, if I do not choose to purchase my lot, will I have to pay homeowner dues?

A: No, renters will not pay any dues, and it cannot be added to their rent. (Document # 2, page 2)

Q: What specific source is the "rental market level" for establishing rents?

A: Pursuant to state law, the "market level" rents must be determined by a licensed appraiser, and will be determined on comparable rental spaces in the area. Because Mesa Dunes has more than 100 spaces that are currently at or near market level, this should prove a good basis of comparable market. Please remember that lower income residents, regardless of whether or not you are currently under rent control -- will be provided strictly limited rent increases (CPI or less), pursuant to state law, for as long as you live in the park. (Document 12, page 4)

A: If you are currently residing on a long-term lease, you will have the option to continue your lease to its termination, or to terminate your lease at the time of conversion and rent under the provisions of State law as described below. (Document # 2, page 1)

Q: After the conversion, if I do not choose to purchase my lot, what will happen to my rent?

A: If you are a lower income household: Conversions are only permitted under State law with strict rent control protection for lower-income residents who choose to continue residence as a tenant. Your rent increases will be limited for as long as you live in the Park.

Rent for lower-income residents will not go up any faster than allowed under local rent control (if applicable), and may increase less. After conversion, rents may only increase by the amount of the average increase in the prior four years (e.g. if rent has increased an average of $5 a year over the past four years, future annual rent increases can only be $5) or by the recent inflation rate (CPI), whichever is less. This provides certainty and security by using a formula for calculating rents for as long as you choose to reside in the park.

To qualify as a lower-income household for calendar year 2013:

(Document # 2, page 1)

A: If your household is above lower income: The monthly rent may gradually increase to market levels in equal annual increases over a four-year period. The "market" rent must be determined through an appraisal conducted by nationally recognized professional appraisal standards.

HOWEVER - In an effort to lessen any possible impact to renters, the owner of Mesa Dunes has opted to extend the gradual increase to a five-year period.

State rent control further protects all non-purchasing residents because it does not allow additional rent increases for capital improvements, a fair return on investment, or government mandated expenses, or similar additional rent increases, and provides certainty by using a formula for calculating rents.

(Document # 2, page 2)

Q: After the conversion, if I do not choose to purchase my lot, will I have to pay homeowner dues?

A: No, renters will not pay any dues, and it cannot be added to their rent. (Document # 2, page 2)

Q: What specific source is the "rental market level" for establishing rents?

A: Pursuant to state law, the "market level" rents must be determined by a licensed appraiser, and will be determined on comparable rental spaces in the area. Because Mesa Dunes has more than 100 spaces that are currently at or near market level, this should prove a good basis of comparable market. Please remember that lower income residents, regardless of whether or not you are currently under rent control -- will be provided strictly limited rent increases (CPI or less), pursuant to state law, for as long as you live in the park. (Document 12, page 4)

Q #3 - Will moderate income residents’ rent be protected if they choose not to buy?

A – Yes. The park owner has promised that residents who choose to continue to rent their space may continue to renew their long-term leases. Approximately 88% of park residents are on long-term leases.

There are only approximately 40 households in the rent-controlled section of the park that are not on long-term leases. Most or all of these households are presumably low-income ($60,300 annual income or below for a 4-person household, $48,250 annual income for 2-person household).

Lower income residents will have the choice to continue on their lease, or to go under state rent control which will limit annual rent increases to the change in the Consumer Price Index (CPI) or to the average increase in the past four years (2.43%) – whichever is less.

If there are any above-lower-income residents who are not on long-term leases, state rent limits will only allow their rents to increase gradually over a five-year period to market rents. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

A – Yes. The park owner has promised that residents who choose to continue to rent their space may continue to renew their long-term leases. Approximately 88% of park residents are on long-term leases.

There are only approximately 40 households in the rent-controlled section of the park that are not on long-term leases. Most or all of these households are presumably low-income ($60,300 annual income or below for a 4-person household, $48,250 annual income for 2-person household).

Lower income residents will have the choice to continue on their lease, or to go under state rent control which will limit annual rent increases to the change in the Consumer Price Index (CPI) or to the average increase in the past four years (2.43%) – whichever is less.

If there are any above-lower-income residents who are not on long-term leases, state rent limits will only allow their rents to increase gradually over a five-year period to market rents. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

HOA information.

A: Contract with present management will be for five years after the date of conversion. (Information shared at a small group meeting with Joanne, Susy, Richard Close. JW)

Q: Who will decide the amount of the monthly HOA dues and what will duties of the HOA be?

A: The HOA dues are determined by the California Department of Real Estate (DRE). The DRE will review the inspection report and analysis of the current cost of the park maintenance, operations and expenses and will then approve the amount of the dues. The dues will fund monthly operating costs as well as a reserve fund for repairs and replacement costs. HOA dues in other parks typically fall in the range of $100 - $200 per month. The current park owner must continue to pay dues for all lots that remain as rental units. Ad the park owner is offering $1000 of prepaid due for residents who open escrow in the first year of sales!

Mesa Dunes will continue to be governed at the State level by HCD and Mobilehome Residency Law, and the HOA must operate pursuant to the Davis-Stirling Act. Pursuant to the Davis-Stirling Act, the park will have rules of operation, CC&Rs and bylaws in compliance with State mandates. Document #10, page 1)

Q: What if something "breaks" in the park right after we purchase? Will there be a big assessment to the homeowners?

A: Pursuant to State law, there are Reserve Account requirements. With respect to the park's major components, the current park owner is required by the DRE to deposit funds into an escrow equal to an amount designated by the DRE before a single lot can be sold. The DRE Required Reserve Deposit amount will be based upon the cost amount attributable to the already used portion of the useful life estimated for the Major Components in accordance with the Reserve Account Requirement Study.

Among other things, the Reserve Account Requirements Study is required to (i) identify the Major Components that have a useful life of less than 30 years, (ii) determine the remaining useful life of the Major Components, (iii) estimate the cost of repair, replacement, restoration, or maintenance of the Major Components, (iv) estimate the total annual contribution necessary to defray such costs during and at the end of the useful life of the Major Components.

Before any spaces are permitted to be sold, the DRE will require that the escrow release the DRE Required Reserve Deposit Amount (paid by the current owner) to the Homeowners' Association to help defray certain costs to repair, replace, restore, or maintain Major Components in accordance with the Reserve Account Requirements Study as accepted by the DRE. In this way the funds are already there when the HOA takes over and no individual homeowner should be faced with an assessment.

(Document #10, page 2)

Q: By what date or deadline do you plan to have a final draft of the CC&R's? Will a draft be disclosed to residents prior to submission for subdivision approval?

A: Upon conversion, there will be a homeowners' association formed. The Covenants, Conditions and Restrictions (CC&Rs), together with the Bylaws are the documents that will govern the park and homeowners' association. These legal documents must be drafted, approved by the California Department of Real Estate (DRE), and distributed to the residents prior to the offering of any lots for sale.

At the time we draft them for submission to the DRE, if any resident would like to see the draft we can certainly provide that to them upon request.*

*UNANSWERED QUESTION: Can homeowners be involved in the process of drafting the CC&Rs?

The DRE application process is the final phase of the subdivision (and we must have County approval of the tentative map before applying to the DRE), and the issuance and delivery of the Final Public Report will be the final requirement before any lots can be offered for sale, which will be more than a year from now. (Document #12, page 1)

Q: Who will prepare the HOA Operational Budget? Will it be disclosed to the residents prior to sales?

A: The HOA Operational and Reserve Budgets are yet another requirement of the DRE. The budgets will be prepared by an outside company that specializes in preparation of HOA budgets and is familiar with the requirements of the DRE. As required by law, the operational budget will be prepared using actual data from the Mesa Dunes showing past and current operational costs. The reserve budget will be prepared using information provided in an inspection report that is prepared by a company that specializes in reserve studies of mobile home parks. The budgets must be approved by the Department of Real Estate (DRE), and distributed to the residents prior to the offering of any lots for sale. (Document #12, page 3)

Q: Who will prepare the HOA Reserve Budget study? Will it be disclosed to residents prior to sale.

A: See above. (Document #12, page 3)

Q: Will the Reserve Budget identify, by line item, each Capital Improvement and Capital Replacement?

A: Yes, the budget will show line items of all operational and reserve components (and their useful life), and are required to project future costs. (Document #12, page 3)

Q: Will expected future piped-in water costs be factored into the Reserve Budget?

A: The reserve study inspection will identify and determine the appropriate reserves for utilities and other common area facilities. (Document #12, page 3)

Q: Upon close of escrow, will each lot's 1/304th share of the Operating Budget and Reserve Budget be paid to the HOA by the owner?

A: Prior to the offering of any lots for sale, the current park owner must obtain a bond for one year's worth of HOA dues, to guarantee full funds. As lots are sold, the new lot/homeowner will be responsible for paying the dues for his lot, and the current owner must continue to pay the dues for each unsold lot. The DRE will also require that the escrow release the DRE Required Reserve Deposit Amount (paid by the current owner) to the Homeowner's Association to help defray certain of the costs to repair, replace, restore, or maintain Major Components in accordance with the Reserve Account Requirements Study as accepted by the DRE. (Document #12, page 3)

Q: Is a geological, civil engineering, study planned for the unstable north slope behind spaces 243 to 252?

A: As above, the reserve study inspection will identify any existing issues in the common areas of the property, and the DRE will determine what, if any, mitigation may be required. The DRE will not approve the subdivision if there are unresolved issues. (Document #12, page 4)

Q: How many drinking water wells does Mesa Dunes have?

a. How deep is each well?

b. What are the current water depths?

c. How deep are the current pumps placed?

d. At what water level is salt water expected to intrude?

A: There are three drinking water wells at Mesa Dunes. I do not know the depths. However, I do know that information about the wells, their viability, and their oversight will be required by the DRE.

(Document #12, page 4)

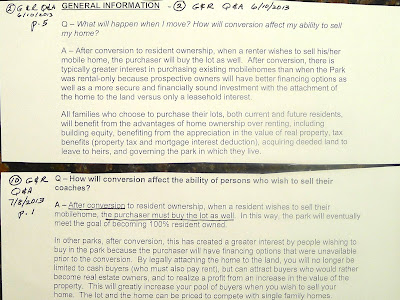

General Information. (Click on the image to see a full size version)

Q #6 - Why did the survey contain the option to respond that I am low-income and will

need financial assistance to purchase my unit?

A – The resident survey contained a specific question/response to assist us in determining how many low-income residents supported the conversion not simply because it would provide them with strict state rent increase limits but because they are potentially interested in the opportunity to buy their lots. This information is helpful as we begin planning for state and other government-supported financing.

Mobilehome park conversions provide a rare opportunity for even low income households to own property, build equity and to have the other advantages of home ownership. “For 25 years, the state has had the policy to encourage and facilitate the conversion of mobilehome parks to resident ownership.”2 “[T]he State had declared itself in favor of converting mobilehome parks to resident ownership, and at the same time established the Mobilehome Park Purchase Fund from which the HCD could make loans to low-income residents and resident organizations to facilitate conversions.”3

(cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7

Questions" ... Document #19)

A – The resident survey contained a specific question/response to assist us in determining how many low-income residents supported the conversion not simply because it would provide them with strict state rent increase limits but because they are potentially interested in the opportunity to buy their lots. This information is helpful as we begin planning for state and other government-supported financing.

Mobilehome park conversions provide a rare opportunity for even low income households to own property, build equity and to have the other advantages of home ownership. “For 25 years, the state has had the policy to encourage and facilitate the conversion of mobilehome parks to resident ownership.”2 “[T]he State had declared itself in favor of converting mobilehome parks to resident ownership, and at the same time established the Mobilehome Park Purchase Fund from which the HCD could make loans to low-income residents and resident organizations to facilitate conversions.”3

2 Sequoia Park Associates v. County of Sonoma (2009) 176 Cal.App.4th 1270, 1298.

3 Sequoia Park Associates v. County of Sonoma (2009) 176 Cal.App.4th 1270, 1293.

3 Sequoia Park Associates v. County of Sonoma (2009) 176 Cal.App.4th 1270, 1293.

(cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7

Questions" ... Document #19)

Q #7 - What were the results of the resident survey of support for conversion to

resident ownership? Why are some people trying to have us do another survey all over

again?

A – Residents voted overwhelmingly to approve the conversion of the park to resident-ownership. More than half of resident households responded to the survey (an excellent turnout – thank you!). Residents who support the conversion outnumbered those who were opposed to it by nearly 3-to-1 (99 “Yeses” vs. 35 “Nos”). Thirty-four (34) residents were undecided and checked “decline to respond at this time.” It is our goal to convince the undecided and those who have not been actively participating to fully support the conversion and to help us make the conversion successful and beneficial for everyone.

Because of the landslide support for the conversion, the attorney hired by the HOA Board to stop the conversion is now claiming that the HOA Board did not give its approval for the survey. That is absolutely, indisputably and demonstrably untrue! Attached to this flyer is our letter to Mr. Constantine citing witnesses, documents and subsequent events which prove otherwise.

Even though the survey has been conducted, we will continue to work hard to build your support for the conversion, be available to answer all your questions, and to continue to keep you fully informed of the progress. Many residents want the opportunity to buy their lots, many will want to continue to rent but welcome that their park will be resident-owned and resident-controlled, and others oppose any change. Irrespective, we want everyone to be as informed as possible with accurate information, and to minimize unnecessary concern or confusion. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

A – Residents voted overwhelmingly to approve the conversion of the park to resident-ownership. More than half of resident households responded to the survey (an excellent turnout – thank you!). Residents who support the conversion outnumbered those who were opposed to it by nearly 3-to-1 (99 “Yeses” vs. 35 “Nos”). Thirty-four (34) residents were undecided and checked “decline to respond at this time.” It is our goal to convince the undecided and those who have not been actively participating to fully support the conversion and to help us make the conversion successful and beneficial for everyone.

Because of the landslide support for the conversion, the attorney hired by the HOA Board to stop the conversion is now claiming that the HOA Board did not give its approval for the survey. That is absolutely, indisputably and demonstrably untrue! Attached to this flyer is our letter to Mr. Constantine citing witnesses, documents and subsequent events which prove otherwise.

Even though the survey has been conducted, we will continue to work hard to build your support for the conversion, be available to answer all your questions, and to continue to keep you fully informed of the progress. Many residents want the opportunity to buy their lots, many will want to continue to rent but welcome that their park will be resident-owned and resident-controlled, and others oppose any change. Irrespective, we want everyone to be as informed as possible with accurate information, and to minimize unnecessary concern or confusion. (cut and pasted from Document #20 Susy Forbath's response to William Constantine's "7 Questions" ... Document #19)

Unanswered Questions:

What mechanisms will be used to change lot prices after the 6 months when the owner will hold them to the price at conversion? Will residents be notified when lot prices change? If a non-lot-owning resident wants to sell his or her unit, how will he or she know the price of the lot? Will that price be flexible during the negotiation of the sale?Are there any circumstances where the land under a unit could be sold without the unit owner's permission?

Author Affiliation: This blog does not represent legal opinion, park management, park ownership, the Homeowners' Association or any other person or entity other than the author (See About). However, information, ideas, or opinions from all of the above are welcome.